By Nathan Brannen on 29 June 2022

The pace of innovation in the automated valuation model (AVM) space is staggering. Traditional valuation giants that have historically dominated the space have been met by new upstarts with truly innovative ways and techniques to improve valuations. If Google is any indication, the sheer number of AVMs globally has more than doubled in just the last few years. With home prices having skyrocketed in the past 18 months, we wanted to highlight four key areas impacting the evolution of AVMs.

Listing data

It may surprise you to learn that valuation models haven’t always leveraged MLS data, easily the most complete property dataset. Nowadays, this data is seen as essential. AVMs incorporate listing data and adjust to the listing price of homes as they come on the market. Beyond the wealth of up to date property characteristics in the listing data, companies are also able to analyze and leverage the relationships between listing prices and the eventual sale price. This enables AVMs to anticipate how homes in that market are currently selling relative to their asking price and make valuation adjustments accordingly.

An inevitable side effect of this is that AVMs can also account for a home’s list price as part of its valuation estimate. If you check a few publicly available AVMs for an estimate of a property before it’s listed and then again a week after it’s listed, you’ll see an understandable variance quickly converge towards the listing price.

While this is a boon for the reported accuracy of a given AVM, the downside of this innovation is that it does little to reflect an AVM’s accuracy on unlisted properties, whose valuations are important for iBuyers, refinancing, portfolio valuation, risk assessment and marketing.

Web Crawlers and Text Parsing

The unequivocal “Achilles Heel” of AVMs is their inability to evaluate the condition or quality of a property, though not for a lack of trying. While many AVMs assume an average condition for every property, some AVMs are starting to search for insights by parsing the listing remarks describing the home. You might think that AI engines would be somewhat literal and credulous, but actually, they can learn to interpret phrases like “fixer-upper” and “potential” to indicate poor condition, and “quartz” or “recently renovated” to indicate higher quality. In fact, given enough data, they’ll learn subtler associations than even many human home shoppers.

On the other hand property descriptions have a few drawbacks. They tend to be unstandardized and subjective. Cynical buyers have learned that “enjoy the view of the wildlife in the nearby lake” means that there’s an alligator living in the swamp out back. There are more than 1 million agents in the US and each will add their own unique nuance to their property descriptions, making it impossible for even the best AI to compare properties in a consistent and standardized way.

Furthermore, helpful contemporary text descriptions are only available for properties that are listed, which means that they’re not available for 95% of the housing stock. Over time, their coverage will increase, but their freshness will decline.

Image Recognition

Image recognition, or computer vision, is likely the biggest game-changer for AVMs. While this type of AI began by identifying the features (ie pool, kitchen island, etc.) that are present in a home (and often identified as part of an MLS listing), it also allowed the extent of features to be measured in a way that was previously impossible. AI can easily understand whether hardwood floors extend throughout the property or just a single room. As the technology has developed further, more complex concepts, like the architectural style of a home or the presence and extent of damage, can now be understood.

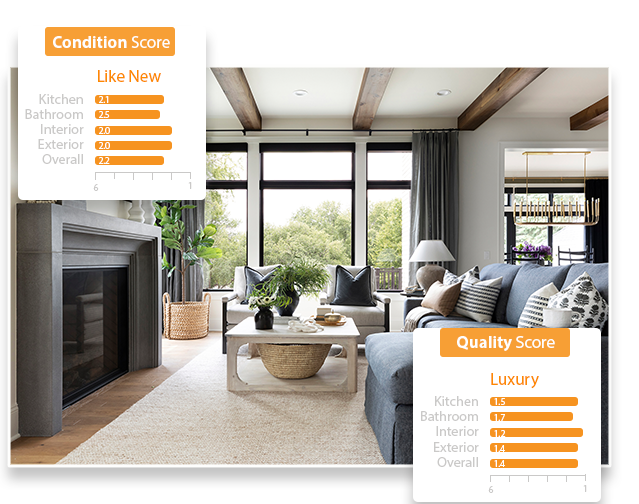

More importantly, AI’s ability to “see” photos allows it to solve AVM’s aforementioned “Achilles Heel”. Computer vision enables the condition and quality of every active and recently listed property to be analyzed and scored in a standardized way. AI can even be trained to be resistant to unintended biases or the influence of things like effective staging, the practice of using rented furniture and interior design skills to spruce up homes for sale.

Restb.ai's computer vision models are being leveraged by AVMs to provide standardized and granular scores of every property's condition and quality

Beyond looking at just an individual property, AI allows homes in a given area to be analyzed and compared at once. While humans may be overwhelmed with the time, effort, and memory needed to look through that many photos, AI can understand how each property’s unique visual characteristics compare to the other homes in its neighborhood, zip code or market.

For example, a market-level comparison can reveal a property’s potential. While a high-quality home in a below-average neighborhood probably doesn’t have much upside for appreciation, a modest home in an up-and-coming neighborhood is primed to outperform the market. Computer vision enables that analysis to be done for every home in the market all in real-time.

Bias

While many of the developments for AVMs are positive, there are some issues that need to be addressed. Discriminatory bias has gone from a theoretical concern to a government action plan in just over a year. Here’s a brief timeline:

- Dec 2020: FHFA creates RFI on appraisal issues, including AVMs

- Sept 2021: Freddie Mac releases study of appraisal bias

- Feb 2022: Fannie’s Appraising the Appraisal study shows a history of appraisal bias

- Feb 2022: CFPB publishes outline of proposals under consideration for regulating AVMs, especially focused on bias and Fair Lending

- Mar 2022: A presidential task force (PAVE) released an Action Plan to address bias in technology-based valuation tools

While AVMs have traditionally looked to leverage any and all data that provides a measurable improvement to their models, a more responsible approach is now required. The recent developments have revealed there is more than enough evidence systemic biases can be unintentionally amplified using big data. AVM companies are being compelled to peek into their black-box models and ensure demographic data is not causing any Fair Lending issues.

At the same time, the spotlight on bias presents an opportunity for AVMs. AI lacks human prejudices and if trained responsibly, has the potential to identify and weed out bias.

What’s Next?

Looking ahead, the rapid innovations in home valuations will only continue. The appraisal industry is experiencing a shift as the ranks of appraisers shrink and activists take aim at accounts of bias. Appraisals were previously thought to be the antithesis of an AVM - an unfeeling, soulless machine, unable to appreciate the finer details of a home. However, people are beginning to see the value of a synthesis between the overworked appraiser with highly developed skills and the power of artificial intelligence with a universe of data. The combination of appraiser and AVM is called a “hybrid valuation,” and there is a growing school of thought that the sum of the two can be greater than its parts.

Meanwhile, AVMs are competing fiercely to be the most accurate, constantly pushing the edges of what people thought was possible. In years past, people thought that AVMs could never evaluate the condition of a property, but in the space of a few years, the problem has largely been solved. Challenges remain, but it’s inevitable we’ll be writing about new developments that were previously thought impossible in the years to come.

Have any additional insights into how home valuations are changing? At Restb.ai, we love discussing how AI and computer vision solutions can be leveraged to enhance the ability of real estate professionals to quickly and accurately value properties. Please send us your thoughts!

comments